Negotiation / Discounting of Inland Letter of Credit

Letter of Credit is one of the instruments to finance a trade transaction on a short- term basis, ranging from 30 days to 360 days, depending on the trade cycle of the respective company and justification allowed by the Issuing Bank. It is a secure and cost-effective option which allows companies to access timely fund flow and enables them to complete their transaction at the best possible terms. The company also benefits from being able to utilize their Working Capital Limits more efficiently.

It assists the Applicant / Beneficiary in various situations such as:

- Ensures the Beneficiary of its payment post supply of goods as it can be negotiated smoothly at the best possible terms

- Applicant (Buyer) can make its own vendor payment programme, by way of issuing the LCs in favour of the supplier and making payment to them post shipment at the best possible terms. In this fashion, the Applicant can control and standardize its cost of purchases across various vendors

- In the case of monopolistic industry, it assists Applicant (Buyer) to make the payment to the supplier at sight, with cost of funding being closer to MCLR of the Negotiating Bank

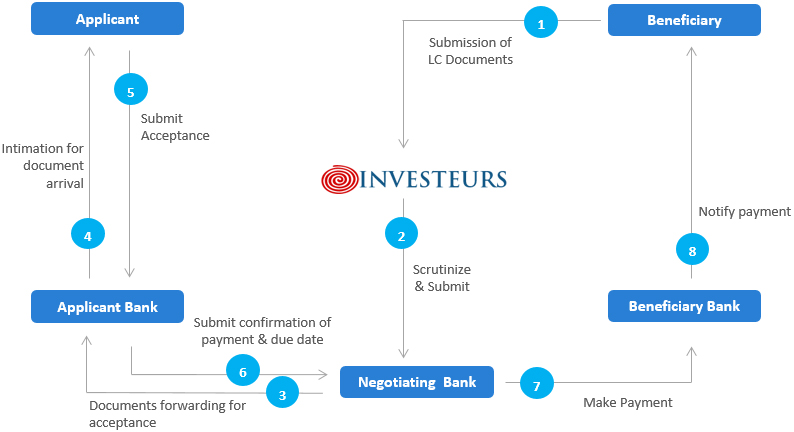

Process Flow of Negotiation / Discounting of Inland Letter of Credit:

Investeurs Effect

- Investeurs extensive experience helps companies in negotiating complex formats and creating lines of credit with ease. Our ability to arrange the most competitive rate of interest available in the market through our bankers enables companies to drastically cut down their interest cost.

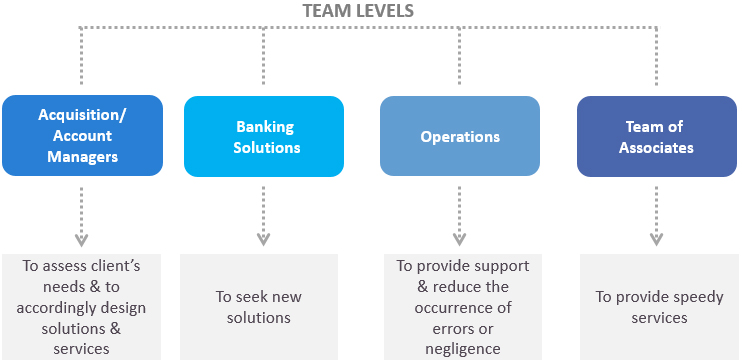

- Our Customer service is first rate – be it timelines, commitments or code of conduct. To ensure an outstanding customer experience, we have created focused teams at every level:

- Customer Software – Bill Master: Our proprietor software provides transaction-related information at the click of a button. The software ensures secured maintenance of Client’s ledgers/transaction over the years. We have various levels of IT security in place to ensure that the client’s information is stored discretely with limited access. We ensure the following services through our Bill Master:

- Updation of movement of transaction, like Forwarding, Acceptance-done, Payment-under-process, Payment details through SMS to the client

- Credit Advice (post discounting) within 4 hours from discounting via e-mail

- Due date maturity, Refund advice – updated records

- Maintenance of data / ledger of discounting data

- Storage of key documents like Bill of Exchange, LC copy, Discounting advice as records maintenance

Financing against Issuance of Bank Guarantee (BG)

A Bank Guarantee is a commercial instrument guaranteed by a Bank to a party (parties) on behalf of his customer, assuring the beneficiary to effect payment on default of obligation. As Bank Guarantee is not a negotiable instrument and cannot be discounted on the beneficiary counter, so the cash flow get stuck even though the payment is safe and can be invoked on due date (as per the BG Contract). To solve the immediate cash flow concern, Investeurs has created a unique model to arrange finance against Bank Guarantee.

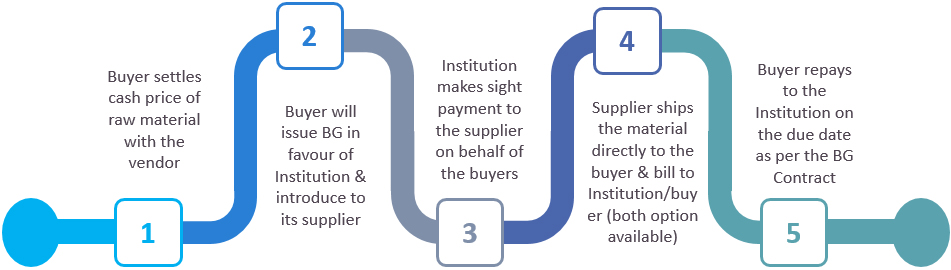

The model assists the buyer to effectively utilize the idle BG Limit by extending a credit line in the form of Purchase Bill Discounting and immediate remittance of funds to the supplier. The buyer can issue a BG in favor of an institution who in turn would make the payment to the supplier and raw material will be dispatched to the buyer. Thus, ensuring credit period to the buyer and immediate cash flow to the supplier.

Salient features of the product:

- Buyer can continue to purchase raw material of multiple products from multiple suppliers against a single Bank Guarantee.

- Buyer gets the cash discount as supplier get the Sight payment / Advance payment.

- The cost of BG financing is much lower than the cash discount offered by supplier and at the same time buyer gets the extended credit lines.

Process flow of Financing Against BG