Debt Syndication

Investeurs advises Corporates on an ideal structure for raising funds, leveraged by strong network and expert assistance until the successful deal closure. With our expertise and deep understanding of clients operating cycle and business, we work towards offering the best possible solution to suit client’s specific requirements. Our relationship with a variety of domestic and foreign lending institutions helps us to serve our clients in their best interest.

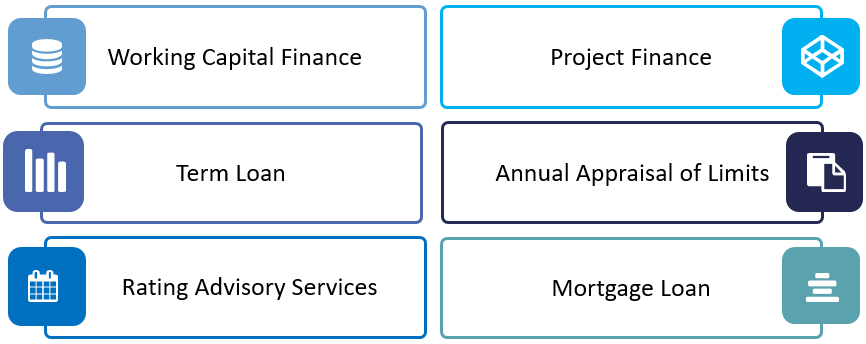

We offer following services:

Working Capital Finance

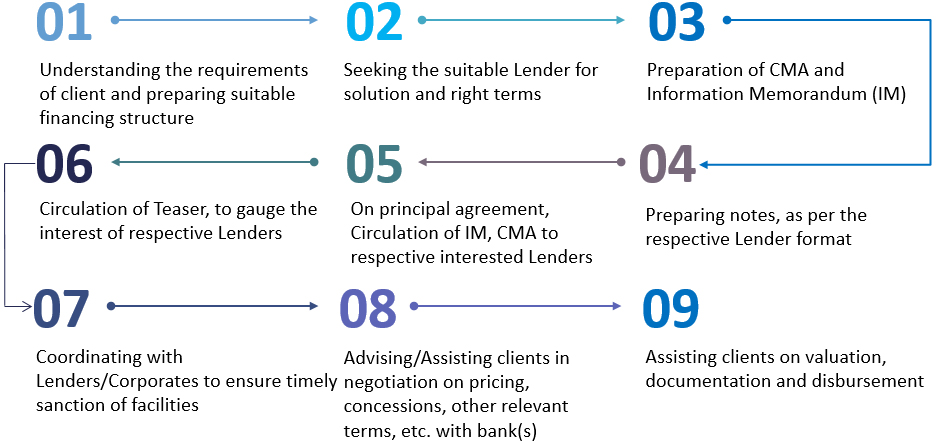

Working capital finance ensures that a company has sufficient liquidity to support its ongoing business operations and maintain a smooth cash flow cycle. At Investeurs, we specialize in arranging working capital finance solutions for businesses across various industries. With our expertise and extensive network of lenders, we provide tailored financial services to meet the unique needs of our clients. As your dedicated working capital finance partner, we are committed to helping your business thrive and succeed.

The process involves:

Project Finance

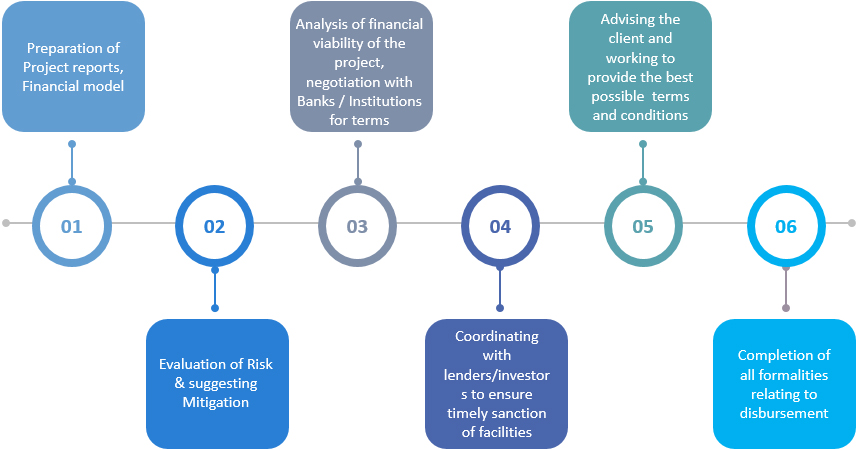

We undertake Project Financing across a wide range of economic sectors like Energy, Education, Hospitality, Healthcare, Warehousing, Metals, etc. We undertake developing Financial Feasibility Reports and assist our clients in creating TEV study reports from various qualified agencies. Based on the project’s requirements and risk profile, we help you devise a robust funding strategy. Our team works closely with you to determine the optimal capital mix and identify potential lenders. We assist in preparing project proposals, conducting due diligence, and coordinating syndication efforts to secure the necessary project finance. Our expertise ensures access to diverse funding sources and the ability to negotiate favorable terms.

We follow the following process:

Term Loan

We provide financial assistance for raising funds for our clients for their expansion plans. Term Loans are extended for the purpose of acquisition of fixed assets, viz. Building, Plant & Machinery or Capex for balancing of capacities, modernization of units, etc.

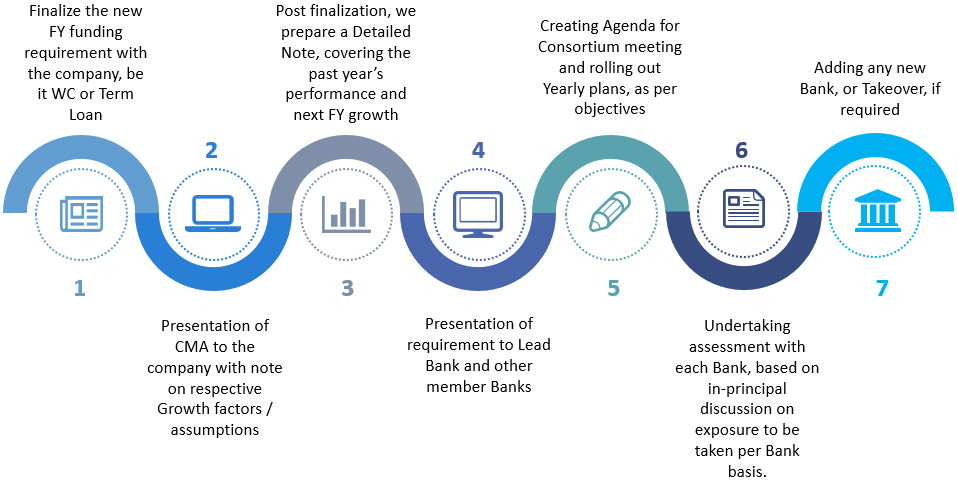

Annual Appraisal of Limits

We provide assistance in performing the Annual Appraisal of Bank Limits under both Consortium & Multiple Banking Arrangement, especially for Mid and Large Corporates. We have the experience of handling Consortium of 8 Banks. We follow the practice in the following manner:

Mortgage Loan

We are dedicated to assist Businesses Secure Mortgage Loans from reputed banks/FIs with favorable terms and conditions. Various funding instruments have been designed to transform cash flows and reshape the liquidity structure through securitization, allowing our clients to finance projects or increase short–term liquidity. By leveraging our extensive network, expertise and personalized approach, we aim to make the mortgage loan process seamless and enable our clients to achieve their financial goals.

We provide following products to meet our corporate client’s short term requirement and with longer repayment terms to consolidate their free cash flow from their day to day operations and have less burden on co.’s books in growing phase.

- Loan against Properties (LAP)

- Lease Rental Discounting (LRD)

Loan against property (LAP) are basically loans provided against the security of one’s own property. One can get a LAP of up to 75% of the registered value of one’s property depending on the lender’s policy and the property type and valuation.

We recommend our clients for this product where need of fund is required for Expansion of business, New business ventures, Short term cash flow mismatch, etc.

Lease Rental Discounting (LRD) is a type of Term loan offered against future rental receipts derived from lease contracts with corporate tenants. The loan is provided to the lesser based on the discounted value of the rentals and the underlying property value. LRD consideration is between the borrower (who own the premises), the tenant (who has rented the said premise) and the lender.

We recommend our clients for this product where fund is required to be generated outside consortium / existing lenders portfolio used for any business purpose.

Rating Advisory Service

We provide specialized Advisory services related to credit rating. Our services include identification and coordination with rating agency, compiling information, developing an optimal rating strategy and execution support for upgrading the Credit Rating.